3 Keys To Hitting Your Homeownership Goals in 2024

If buying or selling a home is your goal for 2024, it’s important to understand today’s housing market, know your why, and work with industry experts to bring your homeownership vision for the new year into focus. Over the last year, the economy had a big impact on the housing market, and likely on your wallet too. That’s why it’s critical to have a clear picture of not just the market today, but also on what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at Realtor.com, explains: “The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.” Here are a few things to think through as you define your goals for 2024. 1. Know Your Why You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are still many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time. Use your why and your motivation as a guidepost in partnership with an expert advisor to make sure your move gives you a lasting sense of accomplishment. 2. Figure Out What Your Next Home Needs To Look Like You know you want to move, but how would you describe your dream home? The number of homes for sale has grown recently, and that could mean more options to choose from when you buy. But overall housing supply is still lower than more normal years in the market, so you’ll have to work closely with a pro to find what you’re looking for. Just be sure to keep your budget in mind as you balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it will be to find a home that’s right for you. 3. Determine if You’re Ready To Buy Getting clear on your budget and available savings is essential before you get too far into the process. Partnering with a me 🙂 and our preferred lender early is the best way to make sure you’re in a good position to buy. This could include planning how much to save for a down payment, getting pre-approved for a home loan, getting information on down-payment assistance programs and how to qualify, and assessing your current home equity if you’re selling your existing house. Buying or selling a home takes expertise to navigate. If that feels a bit overwhelming, that’s normal. Don’t let uncertainty hold you back from your goals this year. I will help you bridge that gap and give you the facts and advice you need about today’s housing market. Bottom Line Let’s connect to plan how to make your homeownership dreams a reality in 2024.

Read MoreYour Credit Score: The Magic Number Behind Your Mortgage Dreams!

Ready for some real-life magic? Not the ‘rabbit from a hat’ sort, but the kind that unlocks the door to your dream home! Yep, I am talking about that seemingly mysterious three-digit number – your credit score! But does it really hold the 🗝️ key to your mortgage approval? Let’s spill the tea! Okay, imagine for a second your credit score is like a report card from your days in school. But instead of grading you on math or English, it’s judging your debt handling skills. Sounds scary? Fear not, we’ve got the deets right here! 1. Credit Score: The Mortgage Gatekeeper In the mortgage world, your credit score is a VIP (Very Important Pointer). Lenders use it to gauge if you’re a risky bet or a sure thing. The higher the score, the less likely you are to default on your loan, in their eyes at least. So, the magic does exist! Your score can seriously sway your mortgage approval chances. 2. Credit Score Tiers: Which Club Do You Belong To? Now that you’re in on the secret, where do you stand? Credit scores usually range from 300 to 850. If you’re sporting a 740 or higher, you’re in the elite club! Lenders will be lining up to roll out the red carpet for you. If you’re between 670 and 739, you’re in the ‘good’ zone. Scores below 670 might mean you need to roll up your sleeves and boost your number before house hunting. 3. The Interest Rate Twist Here’s the twist: it’s not just about the approval, your credit score also affects your mortgage’s interest rate. Higher score equals lower rates. Think of it like a seesaw, when one goes up, the other comes down. 4. Credit Score: The Repair Manual If your score isn’t quite hitting the high notes yet, don’t lose hope. It’s like a bad haircut – with time and a little TLC, it can be fixed. Start by paying your bills on time, every time. Also, try to pay down your debts, especially on credit cards. Keeping your credit usage low is a good look in the credit world. 5. The Big Reveal: Lenders Consider More Than Just Your Score Plot twist! While your credit score plays a huge role, it’s not the only character in your mortgage approval story. Lenders also consider your income, employment history, and debt-to-income ratio. Even with a not-so-great score, these factors could swing the pendulum in your favor. So, if your score is low, don’t despair, your mortgage dreams can still be a reality! In the end, remember, your credit score isn’t just a number – it’s your golden ticket to your dream home! So take care of it, nurture it, and before you know it, you’ll be holding the keys to your castle. And hey, if your score isn’t up to par yet, don’t fret. A bit of financial polish, some time, and responsible habits will have your score climbing up the ladder. Well, that’s all folks, your credit score 101! Now, armed with your newfound knowledge, it’s time to conquer the mortgage world. Will your credit score magic open the gates to your dream home? Only one way to find out! Good luck, credit wizards! (Note: The above blog is a fun interpretation of how credit scores affect mortgage approvals. Readers are advised to seek personalized financial advice for a comprehensive understanding of their situation.)

Read MoreDon’t Expect a Flood of Foreclosures

The rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that a lot of foreclosures are on the horizon. While it’s true that foreclosure filings have gone up a bit compared to last year, experts say a flood of foreclosures isn’t coming. Take it from Bill McBride of Calculated Risk. McBride is an expert on the housing market, and after closely following the data and market environment leading up to the crash, he was able to see the foreclosures coming in 2008. With the same careful eye and analysis, he has a different take on what’s ahead in the current market: “There will not be a foreclosure crisis this time.” Let’s look at why another flood is so unlikely. There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgage Payments One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even if they couldn't show that they’d be able to pay them back. At that time, lenders weren’t being very strict when assessing applicant credit scores, income levels, employment status, and debt-to-income ratio. But now, lending standards have tightened, leading to more qualified buyers who can afford to make their mortgage payments. And data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments is declining (see graph below): Molly Boese, Principal Economist at CoreLogic, explainsjust how few homeowners are struggling to make their mortgage payments: “May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.” Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise. Since so many buyers are making their payments today, a wave of foreclosures isn’t likely. Bottom Line If you’re worried about a potential flood of foreclosures, know there’s nothing in the data today to suggest that’ll happen. In fact, qualified buyers are making their mortgage payments at a very high rate. So don't wait on buying your home - let's get you over to a lender today so you can get pre-qualified.

Read MoreHow Long Does It Take to Close on a Home?

The journey of buying a home can be a thrilling, yet sometimes complex process. One of the most critical stages is the closing, which marks the official transfer of ownership from the seller to the buyer. For many, the time it takes to close on a home may seem like a mystery. In this blog post, we'll break down the key factors that influence the closing timeline and provide helpful tips to ensure a smooth, timely closing process. The Closing Process: What Factors Determine the Timeline? Closing on a home typically takes between 30-45 days, but this can vary depending on several factors. Here are the most common elements that influence the timeline: Mortgage Pre-Approval and Loan ProcessingOne of the first steps in the home-buying process is obtaining mortgage pre-approval. This process can take anywhere from a few hours to a few days. Once you've found a suitable property and have an accepted offer, the loan processing begins. This includes appraisal, title search, and underwriting, which can take 2-4 weeks. AppraisalAn appraisal is required by most lenders to ensure the property is worth the amount they are lending. This process usually takes about 7-10 days but can be longer if the appraiser is backlogged or if the property is unique. Title SearchA title search is conducted to verify that the seller has the legal right to transfer ownership and that there are no outstanding liens or claims on the property. This process typically takes about 1-2 weeks. UnderwritingThe underwriter reviews your loan application, financial documents, and other supporting information to ensure you meet the lender's requirements. This stage may take 1-2 weeks, but delays can occur if additional documentation is required. Closing Date CoordinationClosing dates must be coordinated between the buyer, seller, lender, and title company. Depending on the availability of all parties involved, this can take anywhere from a few days to a few weeks. ContingenciesContingencies are conditions that must be met for the contract to move forward. Some common contingencies include a satisfactory home inspection, appraisal, and financing. Depending on the terms of the contract, the timeline for addressing contingencies can vary. Tips for a Smooth and Timely Closing Process Here are some helpful & very important tips to ensure a successful and timely closing: Get Pre-Approved: Obtain mortgage pre-approval before house hunting to help expedite the loan processing stage. Stay Organized: Keep all important documents and records readily available. Promptly provide any additional information requested by your lender. Communicate: Maintain open lines of communication with your real estate agent, lender, and closing agent. This will help address any issues that may arise during the process. Be Proactive: Schedule inspections, appraisals, and walk-throughs as soon as possible to avoid potential delays. Read and Understand the Contract: Make sure you understand the terms and conditions of your purchase contract, including deadlines and contingencies. While the time it takes to close on a home varies, being prepared and understanding the process can help ensure a smooth, timely closing. By staying organized, proactive, and communicative, you'll be better equipped to navigate this important stage of the home-buying journey.

Read MoreExploring different financing options for buyers

Hey there, home buyers! If you’re in the market for a new home, you’ve probably realized that financing can be a bit overwhelming. There are so many options out there, from traditional mortgages to government-backed loans to alternative financing. So, let’s take a closer look at some of the most popular financing options and find the one that’s right for you! Traditional Mortgages: Let’s start with the most common financing option – the traditional mortgage. With a traditional mortgage, you’ll put down a certain amount of money as a down payment, and then make monthly payments over a set period of time. These loans can have fixed or adjustable interest rates, and the terms can range from 10 to 30 years. FHA Loans: If you’re a first-time home buyer or have a lower credit score, an FHA loan might be a good option for you. These loans are backed by the Federal Housing Administration and often have lower down payment requirements and more flexible credit score requirements. VA Loans: If you’re a veteran or active-duty service member, you may qualify for a VA loan. These loans are backed by the Department of Veterans Affairs and often have lower interest rates and no down payment requirements. USDA Loans: If you’re looking to buy a home in a rural area, a USDA loan might be a good fit. These loans are backed by the U.S. Department of Agriculture and often have low interest rates and no down payment requirements. Alternative Financing: If none of the traditional options work for you, there are a variety of alternative financing options out there, including private lenders, crowdfunding, and even seller financing. Just be sure to do your research and understand the risks involved with these options. So, which financing option is right for you? Well, that depends on a variety of factors, including your credit score, income, and the type of property you’re looking to buy. It’s important to do your research, shop around, and talk to a qualified lender to find the best option for your unique situation. Let me know if you need a lender to speak with. I have great lenders that I work with. One last piece of advice – don’t forget to factor in additional costs like closing costs, property taxes, and insurance when considering your financing options. Buying a home can be a big investment, but with the right financing, it can also be a great way to build long-term wealth and security. Happy house hunting!

Read MoreHow Changing Mortgage Rates Can Affect You

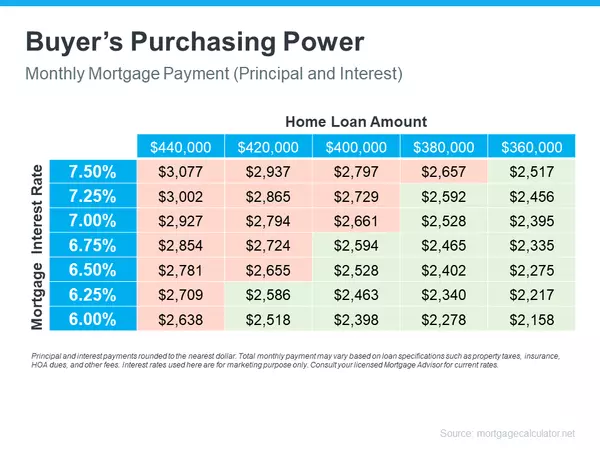

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power. The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment: Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down. What This Means for You You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains: “It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.” That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision. Bottom Line Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so I can connect you with a lender who can assist you with all options.

Read MoreChecklist for Selling Your House This Spring [INFOGRAPHIC]

![Checklist for Selling Your House This Spring [INFOGRAPHIC],Jada Haynie](https://files.mykcm.com/2023/02/22133548/Checklist-For-Selling-This-Spring-MEM-1046x1974.png)

Some Highlights As you get ready to sell your house, there are specific things you can add to your to-do list. These include decluttering, taking down personal photos and items, and power washing outdoor surfaces. Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

Read MoreHow To Make Your Dream of Homeownership a Reality

According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable. However, it’s unlikely all 28 million Americans will accomplish that goal in the coming year. Experts project a total of around five million homes will be sold in 2023. Why is there such a big difference? It’s partly because there can be challenges to buying a home. In the same survey, when asked, “Which of the following are preventing you from pursuing homeownership at this time?”: 34% answered, “I don’t have enough saved for a down payment” 30% answered, “My credit score” If you’re aiming to buy a home, here’s what you need to know to accomplish that goal. Save for Your Down Payment Your down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front (a down payment) and then take out a loan (a mortgage) to pay for the rest. It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. In fact, according to the National Association of Realtors (NAR), today’s median down payment is 14% for the average buyer and just 6% for a first-time buyer. Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Plus, there are even loan types, like FHA loans, with down payments as low as 3.5% for some buyers, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment: Remember to factor in closing costs. In addition to your down payment, closing costs are usually 2-5% of the home's purchase price. Maintain your savings. Your down payment shouldn’t deplete all your savings. It’s important to still have some money set aside for homeownership expenses after you move in. Explore your options and lean on your trusted advisor for expert guidance. Do your research, ask questions, and look into the resources available for buyers like you. Improve Your Credit Score Your credit score is a number that indicates how financially reliable you are to lenders. A higher credit score usually means you’ll be able to borrow more money at a better interest rate. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it. Here are two: Pay your bills on time. When you pay your bills on time, your credit score improves. When you’re late, it takes a hit. One way to make paying your bills on time easier? Set up automatic payments when and where you can. Mix it up. From auto loans, to credit cards, to mortgages – there are several different types of credit. And having a mix of them improves your credit score. Bottom Line If you want to purchase a home this year, let’s connect so we can start preparing.

Read MoreLower Mortgage Rates Are Bringing Buyers Back to the Marke

As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling. Now, however, rates are beginning to come down—and buyers are starting to reenter the market. In fact, the latest data from the Mortgage Bankers Association (MBA) shows mortgage applications increased last week by 7% compared to the week before. So, if you’ve been planning to sell your house but you’re unsure if there will be anyone to buy it, this shift in the market could be your chance. Here’s what experts are saying about buyers returning to the market as we approach spring. Mike Fratantoni, SVP and Chief Economist, MBA: “Mortgage rates are now at their lowest level since September 2022, and about a percentage point below the peak mortgage rate last fall. As we enter the beginning of the spring buying season, lower mortgage rates and more homes on the market will help affordability for first-time homebuyers.” Lawrence Yun, Chief Economist, National Association of Realtors (NAR): “The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.” Thomas LaSalvia, Senior Economist, Moody’s Analytics: "We expect the labor market to remain robust, wages to continue to rise—maybe not at the pace that they did during the pandemic, but that will open up some opportunity for folks to enter homeownership as interest rates stabilize a bit." Sam Khater, Chief Economist, Freddie Mac: “Homebuyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of Millennial renters will provide support to the purchase market.” Bottom Line If you’ve been thinking about making a move, now’s the time to get your house ready to sell. Let’s connect so you can learn about buyer demand in our area the best time to put your house on the market.

Read MoreWhat Should you Ask Lenders When Buying a Home?

Buying a home requires more than finding the perfect home. First, you need financing, or you won’t be able to buy the home. Lenders have specific requirements when considering buying a home, so knowing what questions you should ask them is important. How Much do I Need for a Down Payment? Your down payment depends on the loan program you choose. For example, VA loans don’t require a down payment, but FHA loans require 3.5% down. Conventional loans require 5% down in most cases, and if you put down less than 20%, you’ll pay Private Mortgage Insurance. Discuss your down payment options and how much you should put down to get the best rate and terms on your loan. What’s the Best Interest Rate I can Get? Interest rates are much higher this year than last, so you should talk to your lender about how you can lower your rates. They’ll look at your qualifying factors and tell you what you can improve to ensure you get a lower rate. You can also ask about the possibility of buying the rate down (paying points) to lower the interest rate to keep it even lower. When Should I Lock my Interest Rate? You must lock your interest rate before closing on the loan, but your loan officer can tell you the best time to do it. Most rate locks are free for 30 days, but if you must lock it for longer, it might cost you. It’s best to lock your rate after you sign a purchase contract, so you have a better chance of closing on the loan before it expires, but always ask your lender when it’s the best time to lock. How Much are Closing Costs? You’ll need more than the down payment to close on your loan. You’ll also pay closing costs. Most lenders charge 3% - 5% of the loan amount in closing costs. Ask your lender what the total cost of the loan is so you can budget accordingly. Some loans allow you to wrap some closing costs into it if you don’t have the funds upfront. If you’re worried about affording the closing costs, talk to your lender about your options. Final Thoughts... Knowing what to ask lenders before you buy a home is important. Mortgage financing is one of the most important aspects of buying a home. Without a mortgage, you’d need cash to buy a home, and most people don’t have enough cash for a purchase of that size. It’s a good idea to get quotes from at least three lenders and to get to know their process. No two lenders offer the same rates and terms or have the same process. You might find one lender has an easier process and better rates than another, which can mean the difference of thousands of dollars!

Read MoreWhat Are Your Goals in the Housing Market This Year?

If buying or selling a home is part of your dreams for 2023, it’s essential for you to understand today’s housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus. In the last year, high inflation had a big impact on the economy, the housing market, and likely on your wallet too. That’s why it’s critical to have a clear understanding of not just the market today, but also what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at realtor.com, explains: “The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.” Here are a few questions you can start thinking through as you fine tune your goals for 2023. 1. What’s Motivating You? You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are still many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time and have a space that’s truly your own. Use what’s motivating you as a guidepost in partnership with an expert advisor to help make sure your move will give you a lasting sense of accomplishment. 2. What Does Your Next Home Look Like? You know you want to move, but how would you describe your dream home? The available supply of homes for sale has grown, and that could mean more options to choose from when you buy. Just be sure to keep your budget in mind and work with a trusted real estate professional to balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it can be to find the home that’s right for you. 3. How Ready Are You To Buy? Getting clear on your budget and savings is essential before you get too far into the process. Working with a local agent and a lender early is the best way to make sure you’re in a good position to buy. This could include planning how much to save for a down payment, getting pre-approved for a home loan, and assessing your current home equity if your move involves selling your existing house. A Professional Will Guide You Through Every Step of the Process Buying or selling a home is a big process that takes expertise to navigate. If that feels a bit overwhelming, you aren’t alone. According to a recent Harris Poll survey, one in five respondents see a lack of information or knowledge about the homebuying process as a barrier from owning a home. Don’t let uncertainty hold you back from your goals this year. Let me bridge that gap and give you the best advice and information about today’s market. Let’s connect to plan how your dreams for 2023 can become a reality.

Read MoreThe Cost of Waiting for Mortgage Rates To Go Down

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you’re planning to buy a home. Here’s some information that can help you make an informed decision when you set your homebuying plans. The Impact of Rising Mortgage Rates As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can comfortably afford. Here’s how it works. Let’s assume you want to buy a $400,000 home (the median-priced home according to the National Association of Realtors is $389,500). If you’re trying to shop at that price point and keep your monthly payment about $2,500-2,600 or below, here’s how your purchasing power can change as mortgage rates climb (see chart below). The red shows payments above that threshold and the green indicates a payment within your target range. As the chart shows, as rates go up, the amount you can afford to borrow decreases and that may mean you have to look at homes at a different price point. That’s why it’s important to work with a real estate advisor to understand how mortgage rates impact your monthly mortgage payment at various home loan amounts. Are Mortgage Rates Going To Go Down? The rise in mortgage rates and the resulting decrease in purchasing power may leave you wondering if you should wait for rates to go down before making your purchase. Realtor.comsays this about where rates could go from here: “Many homebuyers likely winced . . . upon hearing that the Federal Reserve yet again boosted its short-term interest rates by three-quarters of a percentage point—a move that’s pushing mortgage rates through the roof. And the already high rates are just going to get higher.” So, if you’re waiting for mortgage rates to drop, you may be waiting for a while as the Federal Reserve works to get inflation under control. And if you’re considering renting as your alternative while you wait it out, remember that’s going to get more expensive with time too. As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says: “There is no doubt that these higher rates hurt housing affordability. Nevertheless, apart from borrowing costs, rents additionally rose at their highest pace in nearly four decades.” Basically, it is true that it costs more to buy a home today than it did last year, but the same is true for renting. This means, either way, you’re going to be paying more. The difference is, with homeownership, you’re also gaining equity over time which will help grow your net worth. The question now becomes: what makes more sense for you? Bottom Line Each person’s situation is unique. To make the best decision for you, let's connect to explore your options.

Read MoreHow Owning a Home Builds Your Net Worth

Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning your home and building your wealth is especially important. If you’re looking to increase your financial security, here’s why now could be a good time to start on your journey toward homeownership. Owning a Home Is a Key Ingredient for Financial Success A report from the National Association of Realtors (NAR) details several homeownership trends, including a significant gap in net worth between homeowners and renters. It finds: “. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.” To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter’s. This difference shows owning a home is a key step in achieving financial success. Equity Gains Can Substantially Boost a Homeowner’s Net Worth The net worth gap between owners and renters exists in large part because homeowners build equity. When you own a home, your equity grows as your home appreciates in value and you make your mortgage payments each month. As a renter, you don’t have that same opportunity. A recent article from CNET explains: “Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home . . . When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.” But on top of that, your home equity grows even more as your home appreciates in value over time. That has a major impact on the wealth you build, as a recent article from Bankrate notes: “Building home equity can help you increase your wealth over time, . . . A home is one of the only assets that have the potential to appreciate in value as you pay it down.” In other words, when you own your home, you have the advantage of your mortgage payment acting as a contribution to a forced savings account that grows in value as your home does. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month. Bottom Line Owning a home is an important part of building your net worth. If you’re ready to start on your journey to homeownership, let’s connect today.

Read MoreWhat Does the Rest of the Year Hold for the Housing Market?

If you’re thinking of buying or selling a house, you’re at an exciting decision point. And anytime you make a big decision like that, one thing you should always consider is timing. So, what does the rest of the year hold for the housing market? Here’s what experts have to say. The Number of Homes Available for Sale Is Likely To Grow There are early signs housing inventory is starting to grow and experts say that should continue in the months ahead. According to Danielle Hale, Chief Economist at realtor.com: “The gap between this year’s homes for sale and last year’s is one-fifth the size that it was at the beginning of the year. The catch up is likely to continue, . . . This growth will mean more options for shoppers than they’ve had in a while, even though inventory continues to lag pre-pandemic normal.” As a buyer, having more options is welcome news. Just remember, housing supply is still low, so be ready to act fast and put in your best offer up front. As a seller, your house may soon face more competition when other sellers list their homes. But the good news is, if you’re also buying your next home, having more options to choose from should make that move-up process easier. Mortgage Rates Will Likely Continue To Respond to Inflationary Pressures Experts also agree inflation should continue to drive up mortgage rates, albeit more moderately. Odeta Kushi, Deputy Chief Economist at First American, says: “… ongoing inflationary pressure remains likely to push mortgage rates even higher in the months to come.” As a buyer, work with trusted real estate professionals, including your lender, so you can learn how rising mortgage rate environments impact your purchasing power. It may make sense to buy now before it costs more to do so, if you’re ready. As a seller, rising mortgage rates are motivating some homeowners to make a move up sooner rather than later. If you’re planning to buy your next home, talk to a trusted real estate advisor to decide how to time your move. Home Prices Are Projected To Continue To Climb Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market. That said, experts agree the pace of that appreciation should moderate – but home prices won’t fall. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains: “Prices throughout the country have surged for the better part of two years, including in the first quarter of 2022. . . Given the extremely low inventory, we’re unlikely to see price declines, but appreciation should slow in the coming months.” As a buyer, continued home price appreciation means it’ll cost you more to buy the longer you wait. But it also gives you peace of mind that, once you do buy a home, it will likely grow in value. That makes it historically a good investment and a strong hedge against inflation. As a seller, price appreciation is great news for the value of your home. Again, lean on a professional to strike the right balance of the best conditions possible for both selling your house and buying your next one. Bottom Line Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Connect with me today to learn more!

Read MoreHow Long Does It Take to Close on a Home?

Buying a house is exciting and overwhelming all at the same time. Not only must you find your dream home, but you must secure financing too unless you’re paying cash. The financing part causes a lot of stress for most people because they don’t know what to expect. One of the largest concerns I hear about is how long does it take to close on a home? How Fast can you Close? When you sign a purchase contract, it’s natural to want to close right away. But it takes time. While it varies by lender, the national average is 48 days. With higher interest rates and a slow in the industry overall, you might see faster turnaround times, though. The Loan Closing Process You might wonder what takes so long to close on a home. It helps to understand the steps lenders go through. You get pre-approved before you look at homes. This allows the lender to review your credit score, income, assets, and liabilities. They use this information to make sure you qualify for any of their loan programs. You work with a reputable real estate agent to find your dream home and sign a purchase contract. Once signed, you give the lender the contract along with any other conditions you can satisfy according to your pre-approval letter. You open escrow. This is where you put money down in ‘good faith.’ This tells sellers you’re a serious and qualified buyer and are willing to risk your funds. A neutral third-party escrow company holds the funds until you close. The lender orders an appraisal and title work on the property. This information tells the lender if the home is a good risk. Is it worth at least as much as you’re paying? Is the title clear? In other words, is the chain of ownership legal and are there any outstanding liens aside from the seller’s current mortgage? This process could take a couple of weeks. Clear any outstanding conditions. At this point, to get to a clear to close, you must provide any straggling documentation the lender needs. Sometimes other issues come up when they review your paystubs, verify your employment, or look at your asset statements. Stay in touch with your loan officer and provide documentation as quickly as possible. Close on your loan. Once you have the ‘clear to close,’ you’re free to close on the loan and take ownership of the home. Final Thoughts It’s always worth asking a lender what their turnaround time is, especially in today’s market. Some lenders are moving much faster than others. If you have a closing date that’s sooner than 30 – 45 days, make sure you find a lender that can work within that timeline. Some of how fast you close a loan depends on how well you cooperate with the lender. The faster you provide the documentation they require, the faster they can clear your loan to close.

Read MoreWhat Factors Affect Mortgage Approval?

Before you look at homes, it’s always a good idea to get pre-approved for a mortgage. This way you know how much you can afford and what your mortgage payment will be and you will be prepared to make an offer on the home of your choice. But, before you get pre-approved, it’s important to know what factors affect mortgage approval. Here are the top factors. Credit Scores Your credit score is the first thing lenders look at when deciding if you qualify for a loan. It doesn’t need to be perfect, but the higher your credit score is, the higher your chances of approval become. Ideally, you should have a credit score of 700 or higher, but if it’s not, aim for at least a 660-credit score. Credit History Your credit history is just as important as your credit score. It shows lenders how you handle your finances. To increase your chances of mortgage approval, make sure your credit report doesn’t show any: Payments over 30 days past due Collections Judgments Credit cards with over 30% of the credit line outstanding Too many inquiries Debt-to-Income Ratio Your debt-to-income ratio shows lenders how much of your income is spoken for already. This includes the new mortgage you applied for too. The higher your DTI is, the lower your chances of approval become. Ideally, your debt-to-income ratio should be 43% or less. You can calculate your DTI by totaling up your monthly debts (car loans, personal loans, student loans, minimum credit card payments, and new mortgage PITI) and divide it by your gross monthly income (income before taxes). If it’s higher than 43%, see what debts you can pay off to lower your DTI. Employment History Most lenders want to see a 2-year employment history. This means two years at the same job with a stable income. If you changed jobs within the last 2 years, but it was within the same industry and it was to make more money or take a better position, you may still be in good standing. Try avoiding changing jobs and/or industries leading up to a mortgage application to improve your chances of mortgage approval. Money for a Down Payment Most loan programs require a down payment. It doesn’t have to be 20% or even 10%, you can get by with 3% - 3.5% down today, but you’ll need to prove you have the funds. Lenders look at your bank statements to ensure the money belongs to you and that it’s yours to spend. You’ll also need money for closing costs which can be 2% - 5% of the loan amount depending on your lender and the qualifying factors. It’s not as hard as it seems to get a mortgage approval, but you should take the time to prepare yourself for the application. The better your qualifying factors are when you apply, the higher your chances of approval become. Also, with higher credit scores, lower debt ratios, and enough money saved for a down payment, you could get more attractive terms and interest rates on your mortgage.

Read More

Recent Posts

![Checklist for Selling Your House This Spring [INFOGRAPHIC]](https://files.mykcm.com/2023/02/22133548/Checklist-For-Selling-This-Spring-MEM-1046x1974.png)